Top 5 Tips on Saving for Retirement

You probably wish for a lavish lifestyle during your sunset years. Therefore, you’ve been sending payments to your retirement savings account religiously, hoping social security will cover your expenses after you retire.

However, the average social security check is $1,500 per month or $16,000 per year. That is hardly enough to cover your basic needs, let alone the inevitable medical expenses.

Considering a 65-year-old has a 50% chance of living beyond 84 years, that translates to budgeting for 20 years of living without a paycheck. To help you out, here are the top five tips on enhancing your savings for retirement.

1. Start saving today

While they say it’s best to start saving when you are young, better late than never. It may seem like an uphill task to save for retirement at an advanced age, but any penny saved is a penny earned.

Although most will tell you to save at least 15% of your income, try saving as much as you possibly can. What you need to save is dependent on several factors, such as your age, what you might inherit, or how long you will work and some other unknowns.

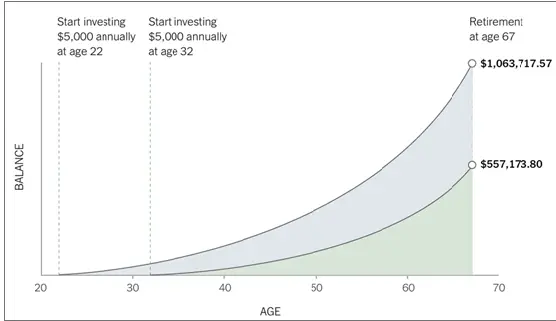

Someone who starts saving for retirement early gains a significant advantage due to the power of compounding. As per the graph below, both savers had a similar 6% interest rate. The only difference is that one started saving 10 years before the other, but they gained almost double their sum.

2. Make the most of retirement savings plans

There are several savings plans, depending on where you work. They are specially made for retirement, so you reap maximum benefit:

- 401(k): available to employees working for profit employers, no tax deductions on deposits and is drawn automatically from the paycheck.

- 403(b): same as the 401k but only available to public schools and non-profit organization employees

- I.R.A: is a tax advantaged savings account that you can use to save and incest for your future. Includes Roth, SEP, SIMPLE and traditional IRAs.

i) Utilize the company contribution match

Some employers may offer to match a certain percentage of your 401(k) or 403(b) contributions. Some employees contribute the maximum allowable retirement deductions to take advantage of the free money from their employers.

ii) Double your retirement plan contributions

All the above plans come with a contribution cap, which is $19,500 for the year 2021. Unknown to many, public sector workers, teachers, non-profit employees and healthcare providers can contribute twice that amount to their retirement savings plans.

In short, they can make an additional $19,500, up to a maximum of $39,000 for the year 2021, with all its accompanying tax advantages.

3. Investing

If you are to go down this route, it’s best to consider growth investments. They can be suitable for long-term investors who can stomach market volatility.

a. Shares

You will receive dividends if a business you invested in made profits. Equities have historically provided the highest returns of all forms of assets, but they are also the riskiest.

b. Real estate

Housing prices can rise substantially over time, delivering healthy returns in the long term. Just like shares, real estate prices can come tumbling down, like during the 2008 recession.

c. Cash

These could be anywhere from standard bank accounts, term deposits or high-interest savings accounts.

For example, parking your cash in a high-interest savings account, such as a certificate of deposit (CD), allows you to save your money using a relatively high and fixed interest rate for a long time.

However, these offer lower returns compared to the previous two.

d. Fixed interest investments

The most common type of this investment is bonds. The government or a reputable company will borrow money from investors, promising to pay you interest at regular intervals until the bond expires.

Its returns are not as attractive, but it is a more secure means of investing than stock trading or real estate investing.

e. Gold IRA's

Investing in precious metals is one of the safest, most secure types of investment on the market. Precious metals such as gold, platinum, and silver cannot be mass produced and therefore always hold intrinsic value

A word of caution – investing comes with serious risks; that’s why it offers such enticing returns. It’s advisable to only invest what you can afford to lose, not your entire retirement savings.

Before you go down this route, learn about investing. Research the best high yield investments to buy or which ventures offer the best risk reward ratio.

4. Move to a smaller house

You’ve had your best years in that house, but the children have left the nest and cleaning that giant house with all its empty rooms has become a pain. It might be time to downgrade.

Getting a smaller home can massively build up your retirement savings. There is a good chance you will get more cash for your home than what you bought it for, ensuring you have some money left over when you purchase a smaller home – which you can save for retirement.

Apart from being cozier and easier to clean, a smaller home comes with smaller maintenance costs. For instance, your HVAC system does not need to condition as many rooms, saving on both power and your electricity bill.

Moving to a retirement community can also be a wise financial decision, especially if you foresee the need for assisted living services. Considering retirement in Carroll, IA can offer a range of affordable options and a close-knit community environment, making your golden years more enjoyable and less stressful. These communities often provide various amenities and healthcare services that could save you money in the long run.

5. Let your age work for you

Growing old has its perks, such as:

i) The Health Savings Account (H.S.A.)

Let’s face it, you will likely have health issues as you grow older, so the government allows you to save towards that using an H.S.A.

Since retirement savings have caps, consider using the H.S.A. to save up to $7,200 for your family in 2021. It grows over time if unused, and you can stash an additional $1,000 per year once you get to age 55. And that’s not even the best bit.

The H.S.A. is a 100% tax-free deductible if you use it for qualified medical expenses. Additionally, the remaining fund inside the H.S.A. is not restricted to healthcare expenses once you reach age 65.

ii) Tax benefits

Through catch-up contributions, the government allows you to deposit more cash towards retirement when you attain age 50. That means you can deposit up to $7,000 to Roth I.R.A.s for the year 2021 or $6,500 more for the other retirement plans up to a maximum of $26,000.

iii) Delaying your social security

Every year you postpone taking your social security after the standard 62 years can significantly increase your monthly and survivor’s benefits. Even a single year’s delay is enough to make an impact.

Bottom line

Since Americans are living longer, you will have to save more. That means you have to prepare to live for two decades without a paycheck. As social security checks are usually never sufficient, you could bridge the deficit by downgrading your home and save the surplus cash, or take advantage of the tax benefits awarded to senior citizens. In addition, growth investments could land you a tidy sum, and optimizing your retirement contributions should bring satisfactory results.